World’s Biggest Real Estate Binge is Coming to a City Near You (Including the Seattle Area…keep reading)

November 14, 2016 — 8:00 AM PST – Bloomberg News:

If they were anywhere else in Beijing, the five young women in cowboy hats and matching red, white, and blue costumes would look wildly out of place.

But here at the city’s biggest international property fair — a frenetic gathering of brokers, developers and other real estate professionals all jockeying for the attention of Chinese buyers — the quintet of wannabe Texans fits right in. As they promote Houston townhouses (“Yours for as little as $350,000!”), a Portugal contingent touts its Golden Visa program and the Australian delegation lures passersby with stuffed kangaroos.

Welcome to ground zero for the world’s largest cross-border residential property boom. Motivated by a weakening yuan, surging domestic housing costs and the desire to secure offshore footholds, Chinese citizens are snapping up overseas homes at an accelerating pace. They’re also venturing further afield than ever before, spreading beyond the likes of Sydney and Vancouver to lower-priced markets including Houston, Thailand’s Pattaya Beach and Malaysia’s Johor Bahru.

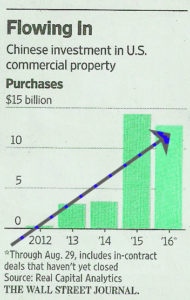

The buying spree has defied Chinese government efforts to restrict capital outflows and shows little sign of slowing after an estimated $15 billion of overseas real estate purchases in the first half. For cities in the cross-hairs, the challenge is to balance the economic benefits of Chinese demand against the risk that rising home prices spur a public backlash.

“The Chinese have managed to accumulate very large amounts of wealth, and the opportunities to deploy that capital in their own market are somewhat restricted,” said Richard Barkham, the London-based chief global economist at CBRE Group Inc., the world’s largest commercial property brokerage. “China has more than a billion people. Personally, I think we have just seen a trickle.”

While a dearth of government statistics makes it difficult to gain a comprehensive view of cross-border real estate investments, most industry projections point to a surge in Chinese purchases. Ping An Haofang, an online real estate platform owned by China’s second-largest insurer, says its $15 billion first-half estimate, derived from market data, nearly matches the figure for all of 2015.

Fang Holdings Ltd., the country’s most popular property website, predicts overseas buying on its system will increase 130 percent this year, while transactions through September at Shenzhen World Union Properties Consultancy Inc., China’s largest broker for new-home sales, were already 50 percent above last year’s level. The country overtook Canada as the largest source of residential purchases in America last year after an estimated $93 billion of buying from 2010 to 2015, according to a May report by the Asia Society and Rosen Consulting Group.

It adds up to the world’s biggest-ever wave of overseas residential property investment, according to Susan Wachter, a professor at the University of Pennsylvania’s Wharton School who specializes in real estate markets. While Japan had a similar boom in the 1980s, it was mainly focused on commercial buildings, Wachter said.

Today’s Chinese buyers have a long list of reasons to flock overseas. The yuan’s slump is eroding their purchasing power, while returns on local financial assets — including stocks, bonds and wealth-management products — are shrinking as the $11 trillion economy slows.

Chinese real estate, meanwhile, has grown increasingly out of reach after a speculative boom sent domestic home prices to all-time highs. Residential property values in Shenzhen, Beijing and Shanghai all jumped more than 30 percent in the year through September, according to the National Bureau of Statistics.

“Properties in Shanghai are ridiculously expensive,” Chen Feng, 38, said as he evaluated prospects at a property fair in Shanghai in September, lured by television commercials for the event the night before. “With the amount of money it takes to buy a small apartment here, I can buy a building of apartments in many places in the world.”

That line of reasoning is nothing new, of course. Sydney, Vancouver, Hong Kong, London and a handful of other cities have long been popular destinations for Chinese buyers.

The difference now is that those traditional hotspots are starting to lose their appeal, due to soaring prices and new measures to deter an influx of overseas money. In Hong Kong, the government enacted a 30 percent tax on foreign property owners this month after Chinese demand pushed home values toward record highs.

The risk of similar measures in other cities can’t be ruled out as politicians including Donald Trump, the U.S. president-elect, tap into local discontent over rising living costs, according to CBRE Group’s Barkham.

Ocean Views

Chinese buyers have responded by branching out to cheaper cities. In the U.S., they’re increasingly searching for properties in Houston, Orlando and Seattle, which displaced San Francisco in the first quarter as the third-most viewed U.S. market on Juwai.com, a Chinese search engine for offshore real estate.

At the national level, countries in Southeast Asia have grown more popular. Juwai.com’s queries on Thailand are surging at a 72 percent annual rate, helping it surpass Britain as one of the top five most-targeted destinations worldwide earlier this year.

In Pattaya Beach, Chinese investors have snapped up 20 percent of the luxury condos on offer from Kingdom Property Co. over the past year. The properties offer Gulf of Thailand views for as little as $120,000, or less than a quarter of what buyers would pay for a typical apartment in central Shanghai, according to Han Bing, a 30-year-old anchor in Chinese television shows who doubles as a sales agent for the Bangkok-based developer.

“It’s a cool bargain for a retirement plan,” Han said.

Capital Controls

In the Malaysian state of Johor, across the Northern border of Singapore, major Chinese builders including Country Garden Holdings Co., Greenland Holdings Corp. and Guangzhou R&F Properties Co. are all developing new projects. Country Garden agents handed out fliers for the firm’s $37 billion Forest City development at the Beijing property fair in September, advertising permanent property rights, zero inheritance taxes, long-term residence visas and high-quality hospitals.

One challenge for Chinese investors is getting money out of a country that caps individuals’ foreign-currency purchases at $50,000 a year. While that limit hasn’t always been strictly enforced, the yuan’s slump is prompting policy makers to clamp down. This year, they’ve banned the use of friends’ currency quotas, curbed on the cross-border activities of underground banks and asked lenders to reduce foreign-exchange sales.

Still, alternative routes abound. Many business owners finance their homes through offshore trading companies, while some Chinese developers allow clients to pay for overseas units in yuan. Foreign-currency mortgages also play a role, helping to fund more than 80 percent of China’s international property purchases, according to an estimate by Fang Holdings based on user searches and surveys.

Planning Ahead

“Where there’s a will, there’s a way,” said David Ley, a professor at the University of British Columbia who wrote a book on the flood of wealthy migrants from east Asia in the 1980s and 1990s.

This year’s purchases could be just be the tip of the iceberg. Chinese holdings of global real estate, including commercial properties, will probably swell to $220 billion by 2020 from $80 billion in 2015, according to Juwai.com.

As the first generation born after China’s opening in the late 1970s approaches middle age, many of them want an overseas base for family members to travel, study and work. Chinese parents with children at foreign schools have been a major source of demand, accounting for an estimated 45 percent of cross-border buying, according to Fang Holdings.

Zha Liangliang, a 31-year-old owner of commercial wheat farms in China’s eastern Jiangsu province, said he purchased a $587,000 apartment in Sydney in August and plans to add five more before sending his children to high school in Australia. He’s flying to the country this month to view homes and farmland, hoping to buy before the yuan weakens any further.

For some investors, it’s never too early to pull the trigger. Richard Baumert, a partner at Millennium Partners Boston, tells the story of a 33-year-old Chinese man who purchased a luxury home for his future children in August, convinced they’re destined to attend one of the city’s prestigious universities.

The buyer shelled out $2.4 million for the property, Baumert said, unfazed by the fact that he’s single and it could be two decades before he has kids old enough for college.

Original Source:

http://www.bloomberg.com/news/articles/2016-11-14/world-s-biggest-real-estate-binge-is-coming-to-a-city-near-you

Note: There is no need to be overly concerned about the new Trump Administration, as mentioned in the article. New opportunities for good deals will be possible. Correct understanding and guidance is important. We are here to assist, just send us a message: [email protected]