By Daniel Goldstein, Personal Finance reporter for MarketWatch.com– Published: July 2, 2016 10:53 a.m. ET

Despite Brexit upheaval and stock market losses, U.S. real estate market appears on much more solid footing in 2016

When it comes to investing in the stock market, you may lose your shirt, but you probably won’t lose your home. In fact, when the equity market gets rough, real estate tends to be a life raft for investors seeking safety.

“Real estate is Americans’ preferred investment for money that they won’t need for at least 10 years and that hasn’t changed,” said Greg McBride, chief financial analyst with New York-based Bankrate.com. “Nervous investors always look to real estate rather than shy away from it in times of volatility.”

While global uncertainty spreads and stocks fall worldwide in the aftermath of the British referendum to leave the European Union, it doesn’t necessarily mean d©j vu all over again, at least when it comes to a repeat of the real estate plunge of 2007. The crash that began that year accelerated sharply following the 2008 rout of the equities market, when home prices in late 2011 were down more than 20% from their peak in spring of 2007.

“There is a lot of Brexit panic going on,” said Francis Greenburger, chief executive of Time Equities Inc., a real estate development firm in New York. “When you realize that this is going to play out over years, and nothing substantive is going to change in the short-term, it seems like an overreaction,” he said.

As a result, here’s why you shouldn’t be panicking post-Brexit if you’re looking to buy or sell a home:

Interest rates should stay low, and could go even lower.

And as markets reel post-Brexit vote, the pace of further Federal Reserve rate increases is likely to slow further, according to Kevin Finkel, senior vice president of Resource America Inc. REXI, -0.10% , a real-estate investment trust in Philadelphia.

“If the Fed had a decision to make to raise interest rates, it gets pushed back further now,” he said. “The slower growth in Europe that Brexit will likely cause and the worldwide global slowdown as a result will force the Feds to drag their feet.”

The Fed was already considering holding off on a summer rate increase when the news was announced earlier this month that the U.S. created just 38,000 new jobs in May and nearly half a million people dropped out of the labor force, raising doubts about the strength of the economy.

“The chances are the Fed is reading the (Brexit) signs as being negative to growth and activity,” said Time Equities’ Greenburger. “As long as inflation remains in check, the Fed is going keep their powder dry and leave rates as they are,” he said.

The 10-year Treasury, which mortgage rates follow, fell as much as 20 basis points since the results of the Brexit vote were announced. For someone in the market for a $200,000 home, the pre-vote rate of 3.46% would have cost $715 for a 30-year fixed-rate mortgage with a 20% down payment, according to Zillow’s mortgage group. A 20 basis point drop would make that monthly cost $697.

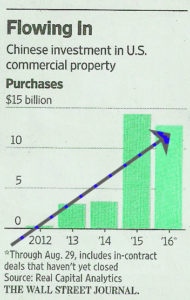

Finkel also notes that the uncertainty in Europe will mean the U.S. will continue to be a haven for real estate investors, pushing prices higher. Indeed, a survey of 700 Chinese real estate investors by the firm East-West Property Advisors Ltd. shortly after the Brexit vote results were announced, showed that 41% of those polled indicated they’d be more willing to invest in the U.S. residential market rather than in the U.K. “Chinese buyers are increasingly interested in the American real estate market because of the perceived safety that places such as New York and San Francisco, now offer compared to London,” the survey showed.

That could help millions of Americans who were unable to refinance because their homes were underwater (meaning they owed more on the home than it was worth). Research firm Black Knight estimates that as many as 7.4 million borrowers could refinance their homes and Brexit could mean even lower interest rates when they do so.

Moreover, as interest rates stay low, the impact of “rate-shock” when short-term adjustable rate mortgages (ARMs) readjust will be minor compared with what happened between 2007 and 2012, when many Americans could no longer afford their new housing payments and defaulted.

One downside to the low interest rates however is that private buyers of mortgage pools, the so-called mortgage-backed securities, are staying away from the market because rates of return are so low. That hurts liquidity and prevents banks from making more loans. As a result, government-sponsored enterprises have to buy up the majority of the loans to create liquidity in the market. According to the Housing Finance Policy Center of the Urban Institute in Washington, D.C., the private label securitization market was valued at $718 billion in 2007 and plunged to just $59 billion in 2008. It was valued at just above $64 billion in 2015.

There’s less risk of a new mortgage bubble

The percentage of loans in foreclosure nationally is the lowest level since April of 2007, according to Black Knight. Foreclosures reached a peak of 4.6% in 2011 at the height of the real estate bust. This year, just 575,000 homes were in active foreclosure in May, down from 800,000 a year ago, a 29% drop, according to Black Knight. While new foreclosures starts last month of 62,100 were up slightly from a 10-year low set in April, they are still 20% lower than a year ago, Black Knight said.

“The recent rise in bank repossessions represents banks flushing out old distress rather than new distress being pushed into the pipeline,” said Daren Blomquist, vice president of Irvine, Calif.- based RealtyTrac, a real-estate research company.

Unlike the 2005 to 2012 mortgage meltdown, when so-called liar loans and exploding ARM’s flooded the market, the subsequent pullback in credit may have been overly tight, but it does mean in 2016 there are fewer real estate bubbles waiting to pop. While it’s true there are markets that have seen incredibly inflated real-estate values such as San Francisco and New York, it’s not fueled by unsustainable and loose credit standards.

“The changes that have taken place over the past five to seven years have built a more stable foundation” in the mortgage industry, said Michael McPartland, a managing director and head of residential real estate for North America at Citigroup’s private bank. “There just aren’t a lot of the exotic products like interest-only [loans] and super-high loan-to-value [mortgages],” he said. “If things slow down, there will be a contraction, but not a pop.”

McPartland says with slow wage growth and high student loan burdens it may be harder for younger borrowers to afford a 20% down payment and monthly interest payments that are principal and interest, instead of just interest-only, but the flip side is increased home equity, so home buyers are less likely to leave the keys on the counter and walk away if things go bad.

Help for first-time home buyers

In 2014, the Federal Housing Administration began reducing mortgage insurance premiums on loans by an average of $900 a year, in an effort to nudge first-time home buyers and millennial borrowers who might not have much cash for a down payment to finally enter the housing market.

Those other federal moves include Fannie Mae and Freddie Mac making lower down payment loan options available to more borrowers. In 2014, the agencies began to buy loans with just a 3% down payment, or 97% loan-to-value ratio. Fannie Mae also announced in 2015 that it would allow income from a non-borrower household members to be considered as part of a loan applicant’s debt-to-income ratio. That could help some borrowers, who might have family members on Social Security or disability living with them, or a renter in a basement apartment, to boost their income levels and help them qualify for a loan.

Lower oil prices

At the end of 2008, gasoline prices, which had risen to a record $4 a gallon nationwide that summer, had crashed to under $2 a gallon. In that case, the cheap gas (and diesel) wasn’t a good thing, as the worldwide economy was shuddering to a halt.

While the U.S. economy (and world economy) is slowing down, the lowest gas prices since 2009, with the national average now close to $2 a gallon is likely to help the housing market.

“The continuing drop in gas prices is freeing up valuable disposable income,” says Resource America’s Finkel, which can help Americans absorb higher rent payments, or move up to a more expensive property.

Job growth

While jobs typically are a lagging indicator of an economic downturn, the U.S. has had a slow- but- steady rate of job creation for the past five years, though that appears to be tailing off in recent months. The U.S. had been averaging more than 200,000 new jobs a month since 2014 until a recent slowdown since March that’s seen hiring taper off to a 116,000 monthly range.

“The recession risks are elevated, but there’s not an abundance of people seeing one over the hood of the car,” said Mark Hamrick, senior economic analyst at Bankrate.com. Hamrick expects GDP growth to rebound in the second quarter at 2% for the rest of the year, which he said will be enough to support expansion in the housing market.

“I don’t think anybody is looking at the payroll numbers and deciding it’s a bad time to buy a home,” he said.

(With additional reporting by Andrea Riquier, Greg Robb and Jeffry Bartash)

Original Source Here: http://www.marketwatch.com/story/5-reasons-a-2009-style-real-estate-meltdown-is-unlikely-now-2015-08-25?link=afterbell